Seasoned multifamily investor Ken McElroy shares battle-tested strategies for succeeding in today’s turbulent market. Explore vertical integration, supply/demand dynamics, vetting operators, and hard-won lessons from his decades at MC Companies.

Discover Bala Krishnan’s 10Y model – a revolutionary real estate investment strategy that prioritizes wealth multiplication through ground-up build-to-rent communities. Learn how discipline, mathematical precision, and an exponential mindset enabled Bala’s journey from tech to financial freedom.

Discover real estate strategies from Neal Bawa, the “Mad Scientist of Multifamily,” as he shares insights on navigating the post-COVID landscape, addressing the affordability crisis, leveraging data science for investment decisions, and seizing opportunities in the chaos.

James Eng, a seasoned commercial real estate professional, shares valuable insights from his journey as an underwriter to becoming a successful multifamily investor. He discusses debt structures, sponsor evaluation, market cycles, and risk management strategies for passive investors in the multifamily space.

Hear the journey of Agostino Pintus as he left a lucrative tech career behind to pursue real estate investing and syndication. Learn his advice on vetting partners, adaptive reuse strategies, outlook for 2024, and more.

As a limited partner, you’ve heard the term “value-add” a few times by now. It’s probably the most overused term in multifamily investing today. If a property was built prior to 2020, there’s a good chance that the sponsor will label it as a value-add. But is it really though? That term references the incoming […]

The cash flow metrics of multifamily syndications are usually the ones that get the most attention from passive investors. In my first syndication investments, I rarely looked at any of the other numbers as long as I knew, liked, and trusted the sponsor and vetted the location of the asset. In the Left Field Investor’s […]

Do you ever ponder how you could replace your salary from your day job, or become less reliant on it, so you could focus more on the things that matter to you? One of the biggest mistakes people make is being dependent on only one source of income – their job. Similar to how insurance […]

Why do we invest? It’s not a trick question. To make money of course! Hopefully enough money that someday we have what we need to live a comfortable retirement. What I find interesting, though, is the lack of control most investors accept when they make an investment. Maybe due diligence was performed, fundamentals were understood, […]

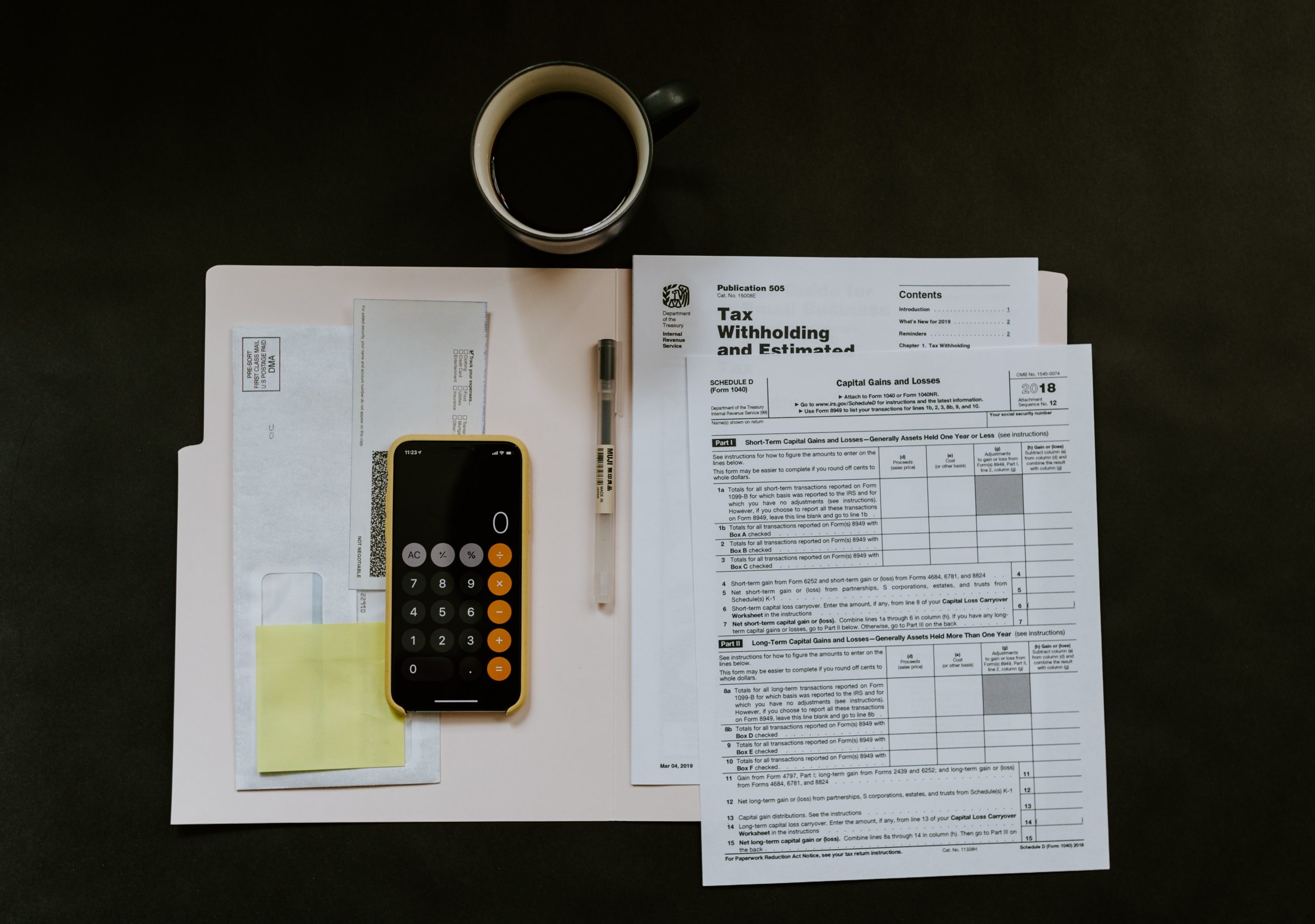

Successful investors are always looking for ways to lower their tax liability. One of the most impactful ways to reduce taxable income is by owning rental properties directly or by investing passively in real estate syndications. If you go the passive route, in most cases the sponsor will utilize a cost segregation study to maximize […]

- 1

- 2