From Underwriter to Multifamily Investor

In the world of real estate investing, knowledge and experience are invaluable assets. James Eng, a seasoned professional with over 18 years of experience in commercial real estate lending and investing, recently shared his insights on the Passive Investing from Left Field podcast with host, Jim Pfeifer. As the national director at Old Capital and a successful multifamily investor himself, Eng has helped investors acquire over $1.5 billion in multifamily properties, totaling more than 20,000 units nationwide.

Eng’s journey began at GE Capital, where he participated in a finance management program that exposed him to various aspects of real estate lending. During his ten years as an underwriter, he gained a deep understanding of the intricacies involved in different commercial real estate asset types, including industrial, office, retail, and multifamily properties. This experience proved crucial when the financial crisis hit, as Eng noticed that multifamily and self-storage properties were the most resilient among the assets he had underwritten.

Understanding Debt Structures

One of the key takeaways from Eng’s podcast appearance was the importance of understanding the differences between Fannie Mae and Freddie Mac financing versus bridge loans. He explained that in 2021-2022, many investors gravitated towards bridge loans due to the higher leverage they offered, often up to 80% of the purchase price plus 100% of the rehab costs. This allowed investors to raise less capital and potentially achieve higher returns. However, the increased risk associated with these loans has become apparent as interest rates have risen, leaving many deals facing significant challenges.

The Role of Preferred Equity in Distressed Deal

Eng also discussed the role of preferred equity in distressed deals. While preferred equity can provide the necessary capital to help stabilize a struggling property, it also increases risk for common equity investors. Preferred equity investors are typically entitled to a higher return and are paid out before common equity investors, effectively reducing the potential upside for those in the common equity position. Eng advised investors to carefully consider the terms and implications of preferred equity before agreeing to its inclusion in a deal.

Eng’s Investment Strategy: Focus on Texas Multifamily

When asked about his personal investment strategy, Eng revealed that he focuses solely on multifamily properties in Texas. While this may seem like a concentrated approach, he believes his deep knowledge of the Texas market allows him to make better investment decisions. He likened the Texas economy to that of Canada, suggesting that investing throughout Texas provides ample diversification. By focusing on a market he knows intimately, Eng can better evaluate deals, operators, and investment strategies.

Managing Risk and Return

For passive investors concerned about decreased cash flow in the current market, Eng recommended focusing on deals with fixed-rate, long-term agency debt (Fannie Mae or Freddie Mac). These investments typically offer more stable, albeit lower, returns compared to riskier bridge loan or preferred equity structures. He emphasized the importance of understanding the range of potential outcomes when evaluating a deal’s projected returns, rather than fixating on a single IRR number.

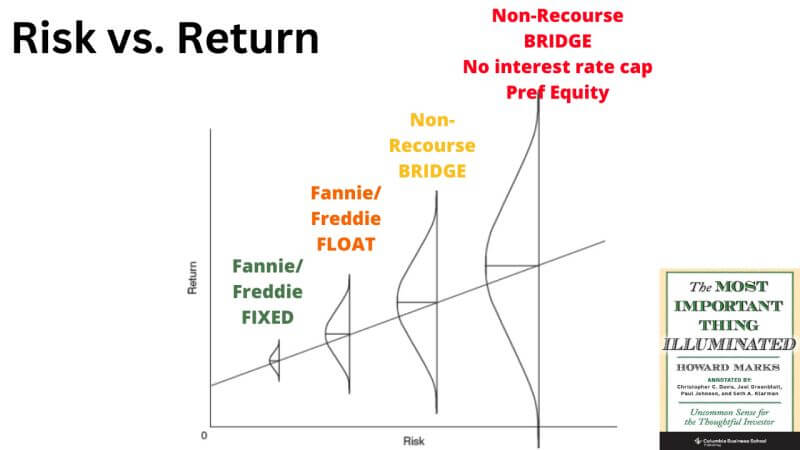

Eng shared this insightful chart from Howard Marks (re-done to focus on commercial real estate) that demonstrates how different debt structures align with various levels of risk and return. You can learn more here. On one end of the spectrum, fixed-rate agency debt with a 7-10-year term corresponds to a relatively narrow return range, typically 9-11% IRR. These deals are less likely to hit “home runs,” but they also have a lower probability of complete loss. On the other hand, non-recourse bridge loans with preferred equity occupy the opposite end of the spectrum, offering the potential for outsized returns (30%+ IRR) but also carrying a much higher risk of significant losses.

The chart serves as a valuable reminder for investors to consider the potential downside as well as the upside when evaluating deals. Eng noted that investors should be aware of the “yellow lights” and “red lights” in their investment criteria, and be willing to pass on deals that do not align with their risk tolerance and investment philosophy.

The insights shared by James Eng in this article merely scratch the surface of the invaluable wisdom he has accumulated throughout his remarkable journey. To fully immerse yourself in Eng’s wealth of knowledge and gain a deeper understanding of the multifamily investing landscape, it is highly recommended that you listen to the entire Passive Investing from Left Field podcast episode featuring his appearance. By tuning in, you’ll have the opportunity to absorb nuanced perspectives, practical strategies, and thought-provoking observations from a true industry veteran. Don’t miss out on this invaluable resource – make it a priority to listen to the full episode and unlock the potential to elevate your multifamily investing prowess.

Take Your Investing to the Next Level

If you enjoyed James’ wisdom and stories, the Left Field Investors (LFI) Community offers more great resources to advance your real estate investing education.

Become an LFI “Infielder” to access:

- Exclusive educational content and investor training programs

- Off-market investment opportunities from vetted sponsors

- A network of thousands of like-minded passive investors

- Virtual and in-person events to engage with experts

- The support to confidently build your investment portfolio

Whether you are new to passive real estate investing or a seasoned veteran, LFI provides contacts, knowledge, and opportunities.

Join now to take your investing to the next level!