You may have heard that real estate investing is the I.D.E.A.L. investment because you get Income, Depreciation, Equity, Appreciation, and Leverage. To take those concepts a step further, I believe that investing passively in commercial real estate syndications, or private placements, may be the P.E.R.F.E.C.T. investment, especially when it comes to multifamily properties.

Passive

Many active real estate enthusiasts, whether they are wholesalers, flippers, or single-family buy-and-hold investors, are transitioning to the passive investing side because of its ease. Other than some upfront due diligence on the syndicator (also known as the sponsor) and on the actual property itself, this way of real estate investing is, for all intents and purposes, hands-off. Busy W-2 wage earners without prior real estate investing experience are also skipping forward to passive commercial real estate syndications.

After signing all the paperwork and wiring in the money for my share of the property, I may only spend a few minutes a month looking after this investment. Once a month or once a quarter, I will read the email updates on the property and check my bank account to verify that I have received my distributions. This is arguably more passive than investing in the stock market on your own. As an passive investor in these syndications, I am not making any decisions, but for that passivity, I am also not worrying about the rehab crew showing up for my next flip or getting calls from my tenants at 2 AM.

“Don’t work for the money. Let the money work for you.” – Robert Kiyosaki, author of Rich Dad Poor Dad

Equity growth

Another advantage of passively investing in real estate syndications (and all buy-and-hold assets for that matter) is that your equity grows by principal paydown and with appreciation.

Everyone who has bought a home with a mortgage knows that a portion of the monthly payments goes to decrease the principal. Even if there is no increase in the value of the home when it is sold, the equity received back will be higher than the down payment because of the principal paydown. By borrowing 60-75% of the money to purchase the assets, these commercial real estate syndications will give the investors steady, but sometimes forgotten, equity growth through principal paydown when rental income is used to pay off the mortgage.

The greatest potential for equity growth usually occurs through appreciation. Forced appreciation, which involves renovating units and increasing rents, will raise the asset value as I will discuss later in this article. However, investors should not depend only on market, or passive, appreciation simply because the sponsor plans to sell it in five to seven years or because surrounding assets have increased in value. Hope is not a sound investment strategy.

Reduced Risk

Here is the most common question that my non-real estate investing family and friends ask me when I tell them that I invest in commercial real estate: “Is it risky?” I will respond to this question from both a financial and a legal standpoint.

Passively investing in multifamily syndications is one of the safest ways to invest in real estate. With regards to single-family rentals, you are depending on one tenant to pay your mortgage. Occupancy may be 100%, but when that tenant leaves, the occupancy goes down to 0%. With large apartment buildings, you will have many tenants paying rent to decrease your mortgage and give you cash flow. Having a handful of vacancies will not hurt your ability to pay expenses and debts. Even the banks consider large real estate properties to be relatively safe. They are consistently loaning up to 80% of the value of these assets. Imagine asking a bank loan officer for a $4 million loan to purchase $5 million worth of stocks. No bank in the world would do such a thing!

“Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1.” – Warren Buffett

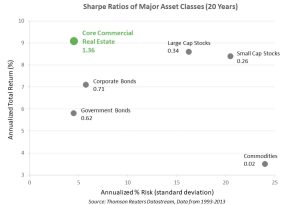

Here is some evidence that apartment investing gives you strong risk-adjusted returns. The graph below shows the Sharpe ratios of the major asset classes over a 20-year period. Developed by Nobel Laureate and Stanford Economics Professor William Sharpe, this calculation is a great indicator of returns because it accounts for the investment’s risk or volatility. A higher Sharpe ratio signifies a better risk-adjusted return. Core commercial real estate, which includes apartment, hotel, office, industrial, and retail properties, had the best return/risk profile – as safe as government bonds while maintaining high total returns. Given its lower volatility and historically great returns, multifamily investments, as a standalone asset class, have an even better Sharpe ratio.

With respect to risk from a

legal standpoint, the managing members or general partners of a syndication are

the ones liable for the actions of the entity. Investing as a passive investor

has the advantage of protection from judgments and debts beyond the asset. They

are only personally liable for the money they have invested in the business

since they do not have an active role in the LLC or partnership. If you own and

rent out a single-family home, you (or your entity) are the “general partner” or managing member in this

investment and thus, assume all liability.

Forced appreciation

As mentioned above, waiting

for passive appreciation to occur merely by holding onto an asset for several

years is not a good strategy. On the other hand, forcing appreciation is a

surefire way to increase rents and, ultimately, the value of the property.

Value-add, multifamily operators will be able to do this by upgrading units and

appliances, adding washer/dryer hook-ups, sub-metering utilities, enhancing

curb appeal, adding amenities, charging pet rent, and decreasing expenses.

The value of a multifamily

property is not dependent on comparable sales of apartments in the area, but

rather on the net operating income (NOI) and the capitalization rate.

The value of the asset is NOI divided by the cap rate.

Here is an example of how

powerful this concept is. If an apartment has an NOI of $400,000 and the market

cap rate is 5%, then the value of the apartment is $8,000,000. Let’s say that

the asset manager (usually the deal sponsor) upgrades the units and decreases

expenses so that the NOI is now $450,000. The asset would now be worth $9,000,000 –

that is the power of forced appreciation!

Economies of scale

Economies of scale are

well-known business concepts that refer to the cost savings that are reaped as

production becomes more efficient. In real estate, having more units,

especially in one geographic location, will permit the owner to be more

efficient and to save on expenses such as management, maintenance, and

purchasing.

Multifamily properties enjoy the best economies of

scale in the residential space. Let’s

compare having a 100-unit apartment complex to owning 100 single-family homes

in three different cities. First off, there is only one closing for the

apartment while the 100 homes may need 100 closings if they were not bought in

a package deal. After finding a multifamily deal, the speed of acquiring that

apartment complex would be many times faster. Building a portfolio of that many

houses would take most people many years. When looking to sell off the

portfolio, there is no competition – the apartment can be sold so much quicker

than 100 houses. The apartment would need one management company while the

collection of houses spread across three cities might need three different

management groups if the owner is not self-managing. Maintenance calls would be

so much easier in an apartment complex, too. Purchasing items like faucets,

toilets, and countertops in bulk could arguably be about the same for both

owners. Marketing efficiency for future tenants would also have to go to the

multifamily property.

Cash flow

Steady cash flow is the lifeblood of

commercial real estate investing. More and more people are looking to get into

these types of syndications because yields from dividend and interest income

are not as high or as tax-favored. With

commercial real estate, the above-average annual returns are aided by using

leverage. Six to twelve months after wiring their initial capital, investors

should expect to see monthly or quarterly distributions. Sponsors who force appreciation by upgrading

units to raise rents should be able to refinance the property within a few

years and return some or all of their investors’ capital. After the sale, the

passive investors should expect to get a lump sum which includes the rest of

their initial investment and hopefully some more gains. A growing number of

people are able to quit their W-2 jobs because they are getting enough cash

flow from multiple passive investments to replace their income.

Tax benefits

One of the hallmarks of real

estate as an investment vehicle is the tax benefits. Every avenue in which the

passive investor gets cash flow is tax-advantaged. If the asset is refinanced a

few years after raising the NOI, the cash that is taken out

and returned to the investors is not taxed. This is the same as when homeowners

do a “cash-out refi” to renovate their kitchen or to finish their basement.

Since that money is borrowed from the loan, it is not taxable.

Depreciation enables the use of passive

loss rules. Most sponsors will have a cost segregation study performed on the

property soon after purchase. This will allow the investors to accelerate

depreciation deductions from 27.5 years (residential assets) or 39 years (non-residential

assets) to 5, 7, or 15 years depending on the component of the real estate. The

real estate-friendly Tax Cuts and Jobs Act of 2017 supercharged the bonus

depreciation to 100% in year one. On the Schedule K-1 for their multifamily

investments, it is not uncommon for investors to get on-paper passive losses of

80-90% in that first year! Therefore, investors will find that most, if not

all, of their syndication income is offset by the generous passive losses,

which can get carried over into future years if not utilized completely. These

losses can also offset any other passive gains like rental income from other

real estate, income from a trade or business in which they do not materially

participate, and royalty payments.

When the asset is sold, there

will hopefully be capital gains from the increase in value not only from the

appreciation but also from the decreased cost basis from the depreciation. The

IRS will tax the latter part of the gain at your ordinary tax rate (depreciation

recapture) and the appreciation part at your long-term capital gains rate

(assuming the asset was held for more than one year). If you plan ahead, you

could participate as a passive investor in another multifamily syndication that

same year to obtain new on-paper passive losses to offset these capital gains.

As you know, there are no guarantees in life

or with investing. If you do invest passively in commercial real estate assets,

make sure you vet the sponsors, the property, the location, and the

actual returns of past deals. Hopefully, this article has

helped to convince you that investing passively in real estate syndications may

be the PERFECT way to accelerate your path to financial and time freedom.

At leftfieldinvestors.com we are dedicated to helping you find trustworthy sponsors and become educated in vetting commercial property deals.

Disclaimer: I am not an accountant, attorney, or financial advisor. You should always seek experts in these areas when investing in any asset class.

Steve Suh is one of the founders of Left Field Investors. He began investing in real estate in 2005 when he bought his business’ office condo. After owning a few small residential rentals and seeing that it was not easily scalable, he transitioned to the world of passive investing in commercial real estate syndications. He enjoys learning and talking about real estate and hopes to educate more people about the merits of passive investing in the Left Field.

Nothing on this website should be considered financial advice. Investing involves risks which you assume. It is your duty to do your own due diligence. Read all documents and agreements before signing or investing in anything. It is your duty to consult with your own legal, financial and tax advisors regarding any investment.