Mark Cuban: “Diversification is for Idiots.”

Important note: If the headline is changed, and drops the Cuban quote, I am including it in a box here for the article lead. But if the quote is preserved in the article, we can delete it here…

“Diversification is for idiots.”

– Mark Cuban

“Diversification is protection against ignorance. It makes very little sense if you know what you are doing.”

– Warren Buffett

Honestly, I was offended by these quotes.

As the manager of a diversified commercial real estate fund, I couldn’t disagree with Mr. Buffett and Mr. Cuban more.

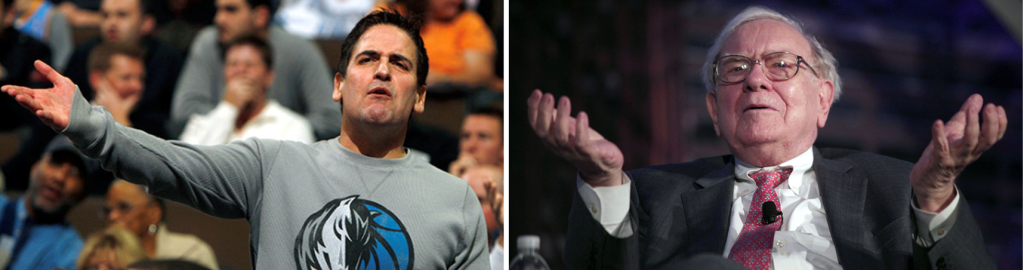

David Zalubowski – Associated Press Politico 3/02/15

David Zalubowski – Associated Press Politico 3/02/15

Yet Buffett is my investing hero, and we model a lot of our investing strategy after his, so I couldn’t just write him off. I was perplexed.

This is important because I am writing a book on Warren Buffett. It’s titled “Warren Buffett’s Rules for Real Estate Investors.” I am reviewing famous Warren Buffett principles and considering how they apply to real estate. Here’s a link to a few of the concepts:

- How I Hired Warren Buffett as My Real Estate Mentor

- Warren Buffett’s Advice to Real Estate Investors: “Stop Skinny Dipping!”

- Warren Buffett’s Strike Zone: How to Earn Grand Slam Investment Returns

So anyway, when I came across this link, I was offended. Irritated. I thought I had finally found something in the business realm I disagreed with Mr. Buffett on.

Then I looked a little closer and thought more deeply about this.

Buffett’s Berkshire Hathaway, if it’s anything, is diversified. Berkshire Hathaway, one of the greatest performing companies and a Fortune 500 top 10 firm, has outperformed almost everyone for the past 57 years since Buffett took the helm.

With a 30.6 million percent ROI, Berkshire Hathaway could lose over 99% of its value—literally—and still outperform the S&P 500 over the same period. Who could beat Buffett’s record? $100 invested with Mr. Buffett in 1965 would be worth about $3 million today.

Berkshire’s diversification stretches from insurers to ice cream, from planes to trains, and from underwear with fruit on the label to phones with fruit on the back. And over a hundred more.

So, after considering this, not only was I offended, but I was also confused. Buffett apparently loves diversification…so how could he say this?

Let’s look a little closer at Mr. Buffett’s life…Warren Buffett is hyper-focused. The first day he met Bill Gates at dinner, he and Gates, two of the wealthiest guys on the planet, agreed that deep focus is the key to success. (Both of them concluded this independently. Take note, Left Fielders!)

Buffett’s life is boring. He virtually never takes appointments, phone calls, or Zoom meetings. He only has a computer to play Bridge, one of his few pastimes. He spends hours a day poring financial reports, multiple daily newspapers, endless company earnings reports, and more.

He is intensely focused, and his time and efforts are not diversified. Berkshire Hathaway’s time and actions are not diversified either. They are one of America’s largest companies, yet they only have 26 or so employees in their Omaha headquarters.

Think about that. A headquarters of a massive company with only 26 people on staff. No PR person, no marketing department. Lean and mean. A 1990’s era website. Highly focused. So, what’s up with this diversification thing?

The Key to Buffett’s Diversified Success

The key to Berkshire’s success and the reason he believes diversification is for idiots (in my humble opinion) is this: Buffett is all about deep expertise. Buffett is all about becoming a master at one’s trade. And Buffett relies on a diverse team of managers who are those deep experts.

In his recent (2022) annual Berkshire Hathaway meeting, Buffett said: “The best thing you can do is to be exceptionally good at something,” Buffett said. “Whatever abilities you have can’t be taken away from you – they can’t actually be inflated away from you.”

Buffett invests with 58 wholly owned subsidiaries, plus 63 holdings in other companies. Every one of these companies is managed by a pro. Someone with blinders on. Someone who doesn’t chase shiny objects. A team of people with profound, specialized, hyper-focused knowledge of their craft, their product, and their company.

For these individuals, diversification would be idiocy. For example, if Dairy Queen started making signs for their 5,700 locations, that would be foolish diversification.

If Clayton Homes started managing RV parks and making loans for self-storage, that would be foolish diversification.

If See’s Candies started a paper mill to make the cardboard boxes for their candy, in my estimation, this would be foolish diversification.

Idiocy. Diversification is for idiots. I get it now. And I am pretty sure that’s what Buffett meant when he said this.

A Few Relevant Examples

If Olympian Michael Phelps somehow magically decided he wanted to win 23 gold medals, he could have taken a diversified strategy like some Olympians of 100 years ago. He could have done the shotput. Javelin. High jump and long jump. Multiple running events.

Phelps could have diversified.

But he didn’t. He wasn’t an idiot in Cuban’s language.

Michael Phelps stayed in his lane, literally. Michael Phelps stayed in the pool and remained hyper-focused on multiple swimming events. He won a gold medal in the 200-meter butterfly. The 200-meter freestyle. The 200-meter medley. The 100-meter butterfly. And a lot more.

But all these were in the water. All of these resulted from Phelps’s hyper-focus. He swam 80,000 meters a week. He trained twice daily, for five to six hours per day. Combined, he swims and lifts weights for four hours a day and runs for two hours a day! And at some point in his childhood, he realized he could get 14% more training by training seven days per week, so he did that, too.

For Michael Phelps, diversification would have been idiocy.

But think about it. As Americans, we got to share in his glory.

We were able to diversify.

We were able to enjoy Michael’s 23 gold medals. But we were also able to watch and enjoy and glory in victories by the 2008 U.S. All-Around Gymnastics champion Nastia Liukin. The 2012 U.S. women’s basketball team. The 2016 U.S. Men’s BMX champion, Connor Fields.

We, as Americans, chose diversification. Just like Buffett chose a diversified strategy of experts within Berkshire Hathaway. Does that make sense?

To take this Olympic analogy a little bit more, let’s think about a different strategy for us as Americans…imagine we had taken Buffett’s comment at face value and applied it to our enjoyment of the Olympics. Imagine we thought it would be necessary to not diversify, but only watch one event. Imagine we had only watched the swimming events, or even just one swimming event.

We would have missed out on the joy and fun and glory of hundreds of other events over Phelps’ five Olympic appearances, from 2000 to 2016.

But we didn’t do that. We got the joy, and the benefit, and the glory of diversified Olympics. We enjoyed the pleasure of diversification and benefitted from the expertise of hundreds of highly skilled, hyper-focused athletes. Each one focusing in on their craft. Each one following Buffett’s strategy. While we followed Berkshire Hathaway’s bigger-picture diversification strategy.

Voila! Magic!

I went on a fishing trip to Alaska recently, so this was on my mind. Think about this…who will likely succeed in the fishing trade? Someone who generally knows how to fish but randomly tries this, that, and the other spot…versus…someone who fishes for the same species in the same location for years. Even decades. This person knows the time of day to go. The depth to fish at. The types of bait to use. The species in the area. The ideal temperature and time of year.

More importantly, the type of bait for the temperature and time of year at the proper depth at the ideal time of day for the right fish.

It’s the specialist who will succeed. But we don’t have to be specialists to savor that salmon.

How Does This Apply to My Investing?

I used to be a certified shiny object chaser. I flipped houses, flipped waterfront lots, did rent-to-own homes, rented out duplexes, and built two realtor websites. I built seven houses (big mistake for me), developed a subdivision, developed and operated a ground-up multifamily facility, helped build a Hyatt Hotel, and much more. I have forgotten some of it.

Honestly, I was not building wealth during those years. I was doing a lot of transactions. I was struggling up a lot of learning curves. I was an idiot, in Mr. Cuban’s words! J

I have taken a lot of Buffett’s teachings to heart. In this case, I have designed our firm, Wellings Capital, to follow in Buffett’s Berkshire Hathaway footsteps.

One reason I love Left Field Investors: they share the same passion and belief.

Wellings Capital invests in self-storage, mobile home parks, RV parks, multifamily, light industrial, and opportunistic retail deals. We are not experts in any of these fields. But we are hyper-focused. What are we focused on?

We are focused on finding experts in each one of these realms. We are focused on performing due diligence to find the very best operators and asset managers in each of these arenas. We put often little-known operators through a grueling 27-point checklist before we consider investing with them.

We say “no” a lot more often than we say yes. We continually strive to partner with the best of the best, and one of our criteria is that they stay focused. So we can broadly diversify.

This helps us. This helps our families. This helps our investors. This lowers our stress levels. And it’s produced safety and satisfying returns across multiple recession-resistant asset classes.

And our investors don’t have to be Buffett’s idiots, either. Our investors typically have full-time jobs, families, and enjoy the lives they want to live. Some of them are enjoying retirement.

They don’t have the time or the knowledge to build a team of people with deep expertise across each of these asset classes.

But with one investment of $50,000 or more, our investors get diversification across multiple asset classes, geographies, operators, strategies, and properties. Each investment is acquired and managed by an expert. Each expert, like Michael Phelps, stays in their lane. All of us, like Olympic fans, get to benefit from their efforts.

Left Field Investors know this is the best way to invest. Investing with those who are true experts…and going wide across a broad array of them. This is why we exist. And this is why many of you are here.

— Jim and the Team at Left Field Investors

I love focus. And I love diversification. And I think Mr. Buffett does, too.

I wouldn’t invest any other way.

This article is for educational purposes only and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision. All investments involve the risk of loss, including the loss of principal. Past performance, and any performance results reflected in this article, is not an indication of future results.

[1] https://www.ngpf.org/blog/investing/question-of-the-day-how-much-would-a-100-investment-in-warren-buffets-company-in-1964-be-worth-in-november-of-2020/