Many real estate investors are aware that high-cash value, or overfunded, life insurance policies are designed to maximize the cash value instead of the death benefit. The cash value growth is typically 5+% tax-free and can have uninterrupted compounding even if policy owners access the cash. It is an ideal place for investors to store cash while waiting for investment opportunities.

When the money is accessed through a loan against the policy and used in an investment, money is working in two places at the same time. Investors can often find favorable arbitrage with investments like ATMs or hard money loans that cash flow well above the interest rate on the loan.

A Lesser-Known Option

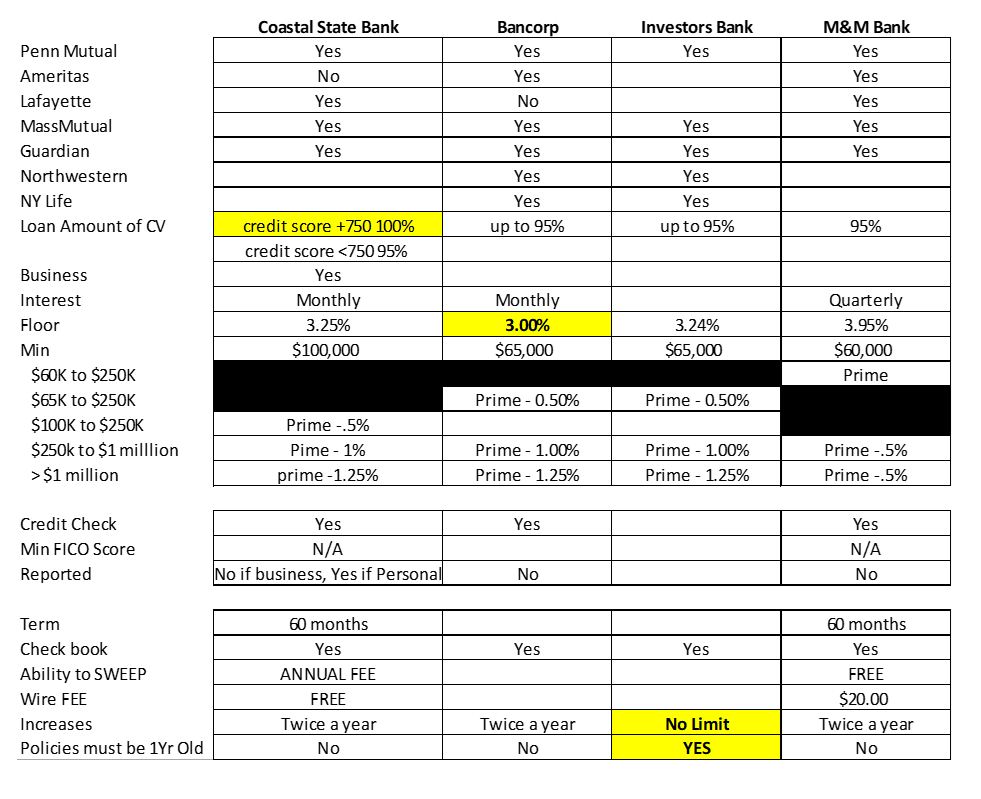

The default option is a policy loan provided by the life insurance company with an interest rate that is typically fixed at around 5%. Some older policies may even have interest rates as high as 8%. However, investors can achieve a lower interest rate and widen the arbitrage opportunity by obtaining lines of credit provided from banks which use the collateral from the cash value of the life insurance policy. At the time that this article was written, the interest rates are based off the prime rate with a margin ranging from 0% to negative 1.25%. The banks require a minimum cash value and rates move lower with higher cash values. Plus, multiple policies can be combined for these thresholds.

The typical rate for cash value above $65,000 is prime minus 0.50%; between $250,000 and $1 million is prime minus 1.00%; and above $1 million is prime minus 1.25% with a floor of 3.00% to 3.25%. These rates can be better than rates on home equity lines of credit (HELOC) for primary residences. Even after a 0.75% increase in the prime rate to 4.00%, the rate can still be at the low-to mid 3% level. With an expectation that the Federal Reserve will raise rates by 0.50% each for the next two FOMC meetings, the rate may go up to 4.00% to 4.50%, but it should still be lower than the rate on the policy loan. If the Fed continues to raise rates and prime ends up be above 6%, causing the rate on these lines to go above 5%, the policy owners always have the option to assign the collateral back to the insurance company to return the policy loan back to 5%. If there is an outstanding balance on the line of credit, a policy loan can be taken out to pay off the line.

How to obtain a bank loan from your cash value

The process to get a cash value line of credit (CVLOC) is easy. The owner transfers the assignment of the life Insurance policy as collateral from the life insurance company to the bank. It involves some very light paperwork with forms that are sometimes only a few pages from the bank and the insurance company. Credit checks will likely be part of the process. But it is nothing like the lengthy process of obtaining a loan to purchase a home. The whole process is typically one to two weeks. Some insurance companies may require a bit more paperwork or notarization that lengthens the process.

Better than a HELOC?

The CVLOC works like a HELOC. Because it comes with a checking account and has online banking access, this line of credit allows policy owners to access money much sooner than an insurance policy loan that typically takes at least three business days. Unlike a HELOC, it does not require closing fees or appraisals. If the cash value increases after the CVLOC is established, getting a line increase is simple. All that is required is obtaining a status report from the insurance company or agent showing that the cash value has increased.

To get an increase on a HELOC, you may need to pay an early termination fee, an appraisal update, and a recording fee. Owners may obtain lines of up to 95-100% of the life insurance cash value versus 80% for the HELOC (and this is combined with the primary mortgage). Also, there are not as many fees compared to a typical checking account. Some banks will even do wire transfers for free.

Furthermore, the interest on borrowed funds may be tax deductible if they are used for business purposes. Also, the CVLOC should not show up on credit reports if the owner can prove that they are using the line for business, rather than personal, purposes. Banks that provide these loans will often allow the interest to be capitalized to the outstanding balance. This provides the policy owner with flexibility if there is a dip in incoming cash flow.

What are the drawbacks of using a cash value line of credit?

First of all, the death benefit will be reduced by the drawn amount, but this is no different than with a direct insurance policy loan.

If the borrowed funds are above the cash value, the policy owner runs the risk of the policy lapsing or being surrendered and, in the process, will trigger a taxable event. However, this is generally difficult to do especially if the dividend rate earned from the insurance company is higher than the interest rate on the borrow funds. Also, most banks only allow the line to go to 95% of the cash value which provides a good safety cushion.

CVLOC users may lose a little bit of control versus a traditional policy loan. If you ever decide to change beneficiaries or owners, you will need the bank to sign off. When the collateral assignment stays with the insurance company, you would not need the bank’s permission for these items. But you could easily re-assign the collateral back to the insurance company and refinance the line of credit with a policy loan to regain these controls if the bank prevented the policy owner from making these changes.

Which bank should you use?

There may be more than half a dozen banks that do lines of credit on whole life policies. Here are the more popular ones I researched and why you may consider any one of these.

Currently, I use Bancorp’s Insurance-Backed Line of Credit because they have the lowest floor of 3.00; however, if prime rate goes up, this may not matter as much.

Coastal State Bank’s Cash Value Line of Credit will give you the highest line amount – 100% of cash value – if you have a credit score of over 750. However, Coastal State Bank requires a higher minimum of $100,000.

Investors Bank’s Personal Insurance Line of Credit is the only one that has no limit on the number of credit increases. All other banks only allow credit increases twice per year. Having no limit on credit increases may be optimal if you have more than two policies, and you want the line increase right after the cash value increased when premiums have been paid and dividends are received on the anniversary date. But Investors Bank requires policies to be at least one year old. So, if you are starting new policies, you may have to stick with one of the other banks first before moving to Investors Bank. By the way, you can easily refinance and switch banks. There aren’t any fees or penalties to get out or to transfer to a new one. It is not like a home loan where you have closing fees that can be a few thousand dollars.

M&M Bank’s Life Equity Loan has the highest rate floor, and they are the only ones that charge interest on a quarterly basis.

The table below summarizes each of these four banks as it relates to these insurance-backed lines of credit.

Chuck Situ is a corporate bond and equities analyst for an investment management firm. He started owning real estate with a condominium in New York City and renting out one of the spare rooms to roommates. Over the years Chuck purchased additional small multi-families and single-family homes. After seeing the difficulty in scaling rentals and the time required managing property managers, he transitioned toward passive investing in syndications in 2021. He invests in ATMs, multi-family apartments, affordable living facilities, self-storage, mobile home parks, resorts, short-term rentals, and private loans.

Nothing on this website should be considered financial advice. Investing involves risks which you assume. It is your duty to do your own due diligence. Read all documents and agreements before signing or investing in anything. It is your duty to consult with your own legal, financial and tax advisors regarding any investment.