Indianapolis, Indiana, metro is home to over two million people. It features a growing corporate base, highly educated workforce, world-class sporting events, high-end cultural attractions, as well as a consistently growing list of shopping, dining, and entertainment options. Residents benefit from an above-average quality of work-life balance, as reflected by consistently high national rankings and a steady flow of new developments and job commitments.

Thanks to this consistent growth, apartment communities are continually in demand. For multifamily syndicators, such as BAM Capital, Indianapolis is the ideal environment for providing consistent cash flow, long-term appreciation, and accelerated tax benefits.

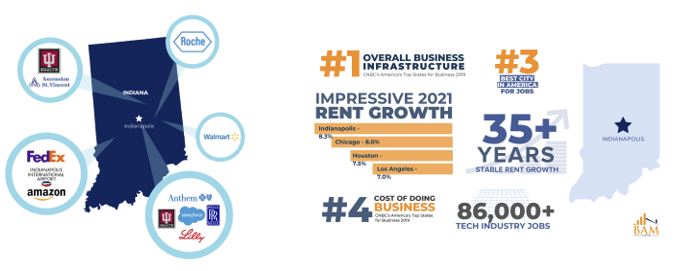

So, why Indianapolis?

- CENTRALIZED LOCATION: nearly 80% of the nation’s population can be reached within a one-day drive, proving to be a critical feature amid the shifting face of retail and logistics

- STRONG CORPORATE BASE: more than ten Fortune 500, Fortune 1,000, regional, national, and international corporations have headquarters or a large presence in the metro area

- HIGHER EDUCATION: more than 20 colleges and universities within 70 miles of the city, providing a highly-skilled workforce

Why Multifamily?

- DEMOGRAPHICS AND EMPLOYEE MOBILITY: increase of 10 million new renters over the past decade. There are 500k new renters per year, but only 300k units are being built annually. An estimated 20-30% of the workforce will be working from home by 2022.

- AFFORDABILITY: single-family home prices appreciated 13.2% YOY. Many households do not have the necessary down payment to purchase a home.

- INFLATION PROTECTION: ability to raise rents to mitigate inflation risks

- TANGIBLE CASH FLOW PRODUCING ASSETS: consistent income stream that is not impacted by the ups and downs of the stock market

- ACCELERATED TAX SHELTER: accelerating the allowable depreciation on the appropriate assets can lead to major tax savings

- RISK PREMIUM & FORCED APPRECIATION: risk premium for owning multifamily may decrease in 2022 and beyond, forcing appreciation (adding value) of assets will remain the dominant strategy for delivering above-market returns.

Conclusion

While Indianapolis isn’t as prominent in peoples’ minds as New York, Austin, or Atlanta when it comes to population growth, it offers stability and consistent results. For multifamily syndicators with a Midwest focus, such as BAM Capital, these market trends help achieve the targeted returns of 15-21% IRR for their accredited investors.

Source: CBRE, Why Indianapolis, 2022

BAM Capital is an Indianapolis-based multifamily syndicator with a Midwest focus that helps accredited investors invest in real estate. BAM Capital is part of the fully vertically integrated The BAM Companies and prioritizes B++, A-, and A+ multifamily assets with in-place cash flow and proven upside potential.

BAM Capital locates high-quality real estate opportunities and negotiates the purchasing and financing on your behalf. They take care of everything from start to finish, making it a truly passive investment. BAM Capital currently has $700M AUM and over 6,000 units. Accredited investors can learn more by visiting the BAM Capital website.

Nothing on this website should be considered financial advice. Investing involves risks which you assume. It is your duty to do your own due diligence. Read all documents and agreements before signing or investing in anything. It is your duty to consult with your own legal, financial and tax advisors regarding any investment.