Before I invest, I’m always thinking about how a particular investment will hold up during the next crisis, whatever it may be. We all know the crisis is coming; we just don’t know when or what form it will take. It’s not often that I make an investment that, in short order, gets tested by something completely unexpected, much less comes through it with flying colors. Well, that’s exactly what happened with my Automated Teller Machine (ATM) investments I began making in late 2017.

I invest almost exclusively in Alternative Investments (things outside the stock market), and the one investment that probably garners the most intrigue and interest is ATMs. While some of us use ATMs more than others, we see them everywhere, and I bet you thought they were owned and operated by the banks. The ATMs you find in the bank lobby or entryway are probably owned and managed by that bank. The rest are just business assets and can be owned and operated by anyone, including investors like me.

ATMs By The Numbers

Before I get into the specifics of my ATM investments, here’s a general overview of the business. According to a 2019 article in PR Newswire, the ATM market in 2018 was valued at $18.5B. There are three primary players in the ATM space, the location owner (the convenience store owner, for example), the ATM owner/investor (the bank or me in this case), and the management company that locates, operates, and maintains the ATMs. All parties are paid a portion of the fees charged to the ATM users, which average around $2.50/transaction. The management company receives 45%, the location owner 25%, and the owner/investor 30%. There is also additional revenue from advertising and signage.

I know what you’re thinking; the last thing you want to do is negotiate the lease of a tiny piece of real estate with a store owner, purchase an ATM, install it, insure it, and maintain it. I totally get it! I own dozens of ATMs all across the country by model and serial number, and I’ve never laid eyes, much less a hand, on any of them. I simply write a check, and these ATMs are purchased, installed, operated, and maintained by third parties. Every month since February of 2018 (even through COVID), I have received a check for $2,155, and this cash flow continues for a total of seven years. At the end of seven years, the ATMs will be old and likely outdated and will be sold.

My Actual Returns

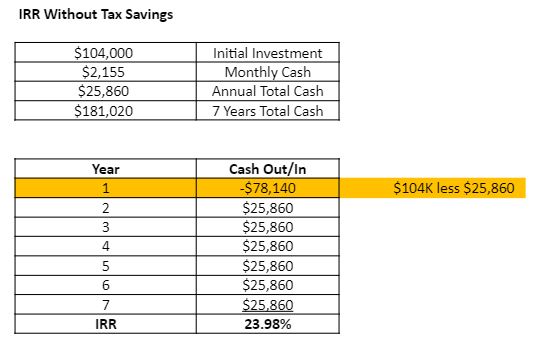

So, what did I have to invest to get this stream of cash flow? I purchased six ATMs for $104,000. The monthly cash flow coming back to me is $2,155/month or $25,860/year for a total of $181,020 over seven years. In the Internal Rate of Return (IRR) calculation below in the second block, the line items are simply the net cash in or net cash out (cash out represented by a negative number) over the seven years. In year one, I purchased the six machines for $104K and received $25,860 back, so my net cash flow out for year one was -$78,140 ($104K less $25,860). My net cash flow in years two through seven will be $25,860. This will result in an IRR of 23.98%.

But wait, there’s more! The ATMs also came with a built-in tax advantage called depreciation.

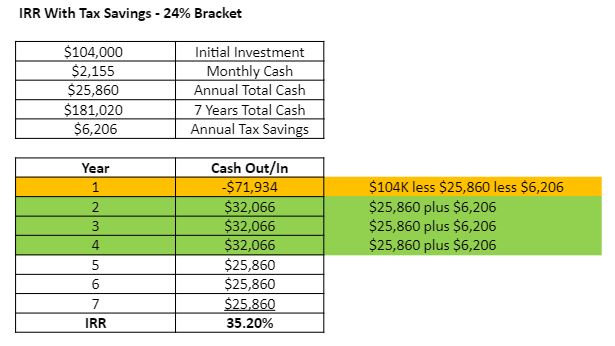

In this case, Bonus Depreciation (While Bonus Depreciation wasn’t available at the time I purchased my first tranche of ATMs, it is available today under the current tax laws.). So let’s recalculate the IRR taking Bonus Depreciation into consideration. My initial investment was $104K. The monthly cash flow coming back to me is $2,155/month or $25,860/year for a total of $181,020 over seven years. Depreciation is the new element in this calculation. I received a deduction or expense of $104K in the same year I purchased the ATMs. I can use this to offset the ATM income itself or other “passive income.” For this example, I’ll use it to offset the ATM income.

This means that I paid $0 income tax on the first $104K of ATM income. With an annual income of $25,860, I will mostly deplete my $104K deduction in four years ($25,860 x 4 = ($103,440). Let’s look at the numbers.

My net cash out in the first year is now $71,934 ($104K less $25,860 less $6,206 in tax savings). How did I come up with the $6,206? If I’m in a 24% tax bracket, 24% of $25,860 is $6,206. My net cash in years two through four will be $32,066 ($25,860 plus $6,206). At the end of year four, I will have used almost all my $104K depreciation ($25,860 x 4 = $103,440).

In years five through seven, I’m back to my net cash in of $25,860. The IRR in this scenario will be 35.20%, an 11.22% increase over the previous example.

Keep in mind that I’m not a CPA or a financial advisor, and this is an oversimplification of depreciation and how it’s calculated. What I’m trying to illustrate is the advantage of investing in an asset that has a built-in tax advantage. In this case, an 11.22% increase in your return!

You might be wondering, if the money I receive as the ATM owner is based on the ATM fees, how is it that I receive exactly the same amount of money each month? Great question! After all, the number of transactions at each ATM varies day to day. I receive what’s called a “blended return.” Instead of receiving a varying amount of money each month depending on the number of transactions of each ATM, my ATMs are managed as a group with hundreds of other ATMs. Regardless of each ATM’s performance in the group, all participants receive the same $2,155/month.

What I’ve described here is not a hypothetical example; I’ve done it many times. With these ATMs, you get at least a 23.98% IRR, more depending on your tax situation.

Are ATMs Risky?

That’s a question that only each investor can answer. They have many of the same risks as any other investment: economic cycles, systemic risks, poor management, political and social unrest, war, natural disaster, technology risks, etc. There is certainly no liquidity with ATMs; you’re in it for the seven-year term. As far as withstanding the economic and systemic risk and the social and political unrest that 2020 threw at us, so far, at least, the ATMs have passed the test, delivering a durable and reliable stream of income throughout.

While I invest almost exclusively in Alternative Investments, I know it’s not for everyone. However, I firmly believe that this asset class has a place in every portfolio.

The Prolific Investor is Chris Odegard. Chris is an average guy who had a white-collar job in the corporate world and followed the only thing he knew for decades, conventional wisdom and conventional investments. This worked relatively well until 2009 when he experienced an illiquidity event where he lost 55% of his assets and thousands of dollars per month in cash flow. Then, Chris read Robert Kiyosaki’s Rich Dad Poor Dad, and his mind was opened to a different type of investing, investing in real assets and private deals mostly insulated from the volatility, risk, and taxation of the stock market. In just nine years, Chris recouped the 55% he had lost and multiplied it many times over and now shares his experience and knowledge with you through this alternative investment blog. If you’d like to learn more about Chris, Alternatives, or ATMs, please visit his blog at www.TheProlificInvestor.net.

Nothing on this website should be considered financial advice. Investing involves risks which you assume. It is your duty to do your own due diligence. Read all documents and agreements before signing or investing in anything. It is your duty to consult with your own legal, financial and tax advisors regarding any investment.