Invest Smarter

with PassivePockets

Access educational resources, private investor forums, and comprehensive sponsor & deal directories — so you can confidently find, vet, and invest in real estate syndications.

Your Passive Investing Toolkit

Investor Community

Investor-only forum spaces and weekly community Zooms – without sponsors or capital raisers.

Sponsor Directory

Explore comprehensive profiles to view sponsor track records, investor reviews, core strategies, and more.

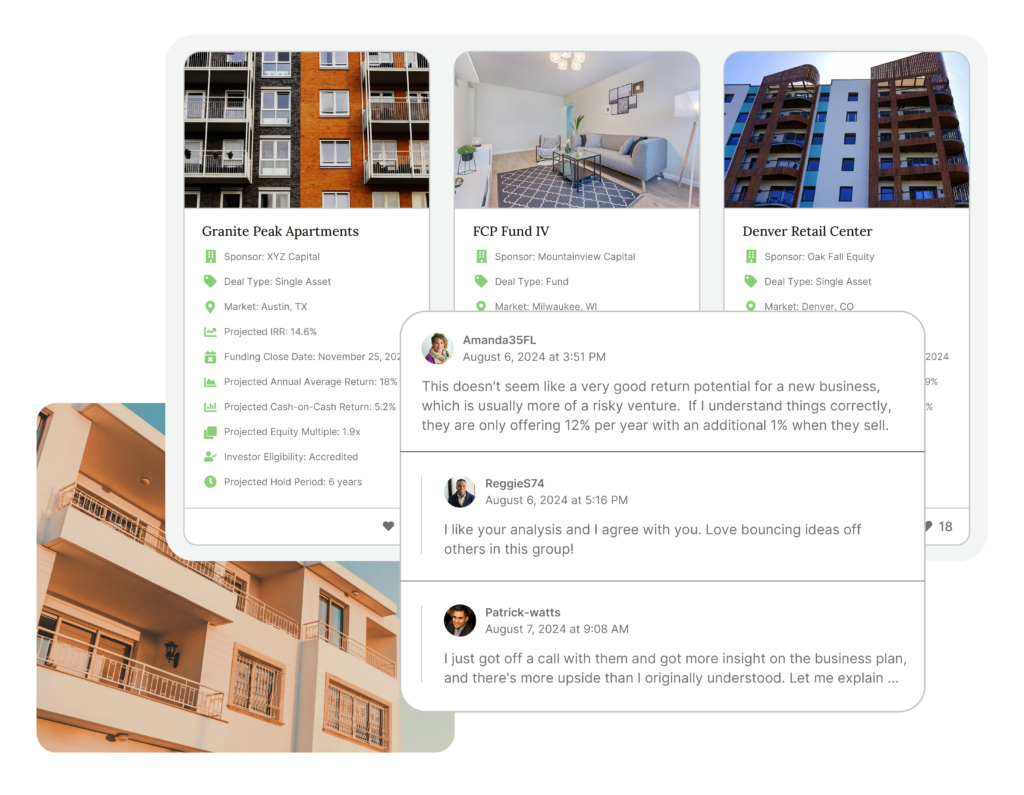

Deal Directory

Dive into deal pages, download materials, watch webinars, and connect with sponsors in dedicated forums.

Ratings & Reviews

Read first-hand reviews from members who have invested with sponsors – the good, the bad, the ugly.

Due Diligence Tools

Robust vetting frameworks and a library of community-sourced sponsor ratings & reviews.

Premium Education

Masterclasses, articles, podcasts, and a weekly newsletter filled with the latest insights.

Simplify Your Investment Search

Easily find sponsors and active investment opportunities — no events, networking or endless Googling required.

- Sponsor Directory

- Deal Directory

- Sponsor ratings & reviews from investors

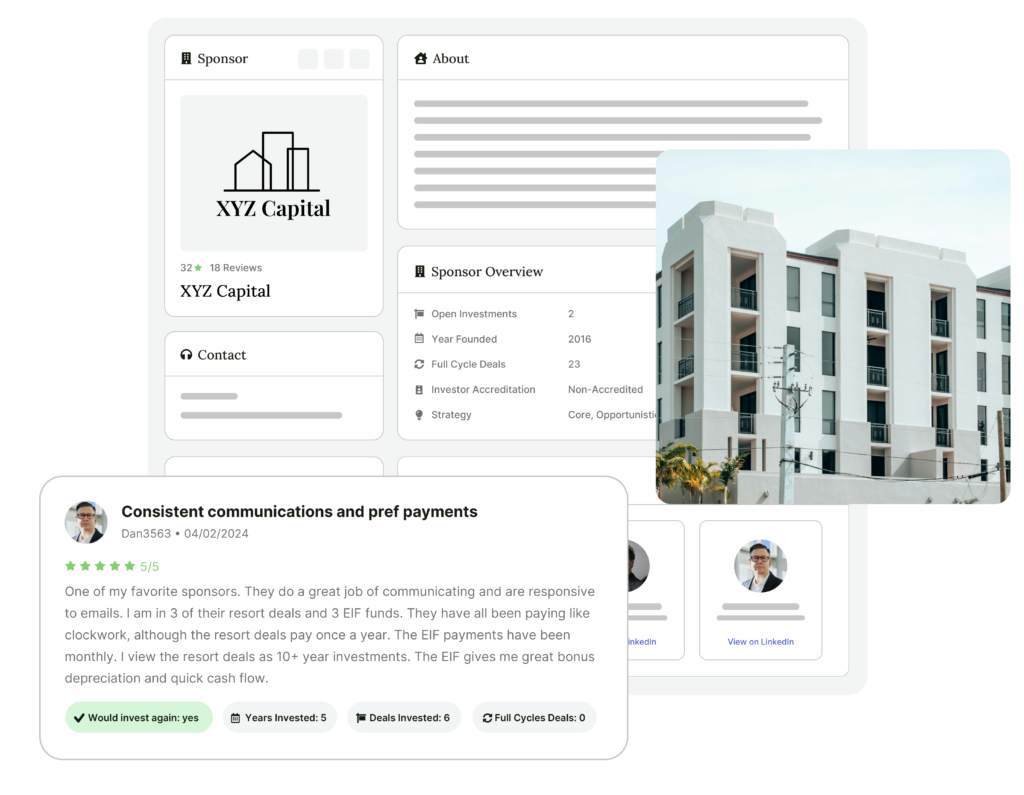

Explore our Comprehensive Sponsor Directory

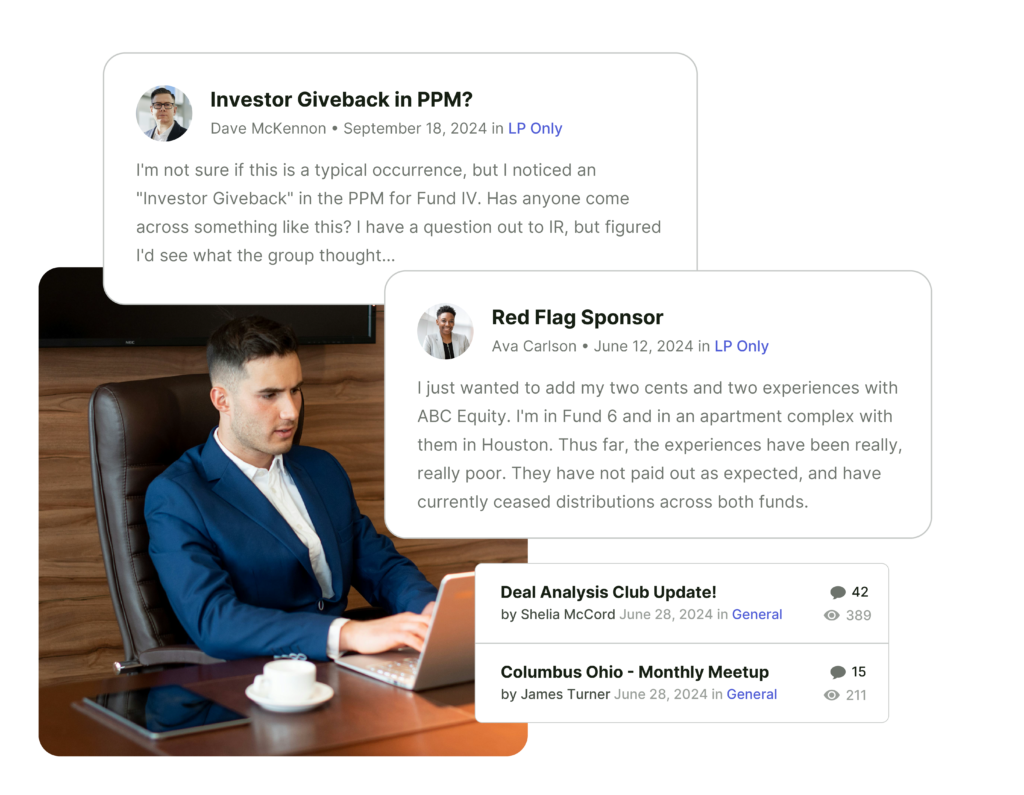

Tap Into the Community

Get unbiased community insights in dedicated investor-only forum areas – no sponsors and capital raisers allowed.

- Investor-only forum spaces

- Forum topics like “Red Flag Sponsors” and “Deep Due Diligence”

- Weekly community Zoom calls

Sponsor Ratings & Reviews

Read first-hand reviews from members who have invested with sponsors – the good, the bad, the ugly.

Solid Performance from Trusted Operator

"I have been investing with them for 4+ years and have been very satisfied. The individual deals have all paid out on time and as expected. There was one deal that had some trouble ... communicated a bit slow on it, but when they did they promised to return all investor capital even if it came out of the pockets of the principals. Showed how they encountered difficulties but also looked out for their investors."

- Member invested in 7 deals (2 full cycle) with sponsor

Never Again

"Eventually, herd mentality got the better of me and I started to invest, and ... invested multiple times in a short span. Needless to say, I have not seen one dollar in cash flow and almost everyone knows of their troubles. The kicker for me ... is the lack of solid communication/messaging at the beginning as well as shortly into the issues and the way they have structured the capital calls (not in the LP's favor, IMO). I am considering all capital to be a loss."

- Member invested in 3 deals (0 full cycle) with sponsor

Great CRE Fund - But Questions Around Other Offers

"I've been in a couple of his big office building to condo rehabs and his CRE funds ... I've really liked the CRE funds. I'm in 3 of them and they have cash flowed very well. The building conversions have been slow to action and difficult to be excited about. Neither have cash flowed a dollar yet and I've been in the one since 2019. Communication has improved some but still isn't best in class by any means."

- Member invested in 6 deals (1 full cycle) with sponsor